News

Cases of Microfinance Projects from India

(October, 2021) Good Neighbors Global Impact Foundation(GNGIF)’ Micro Finance Department shares stories from India. It is expected for you to be inspired by best practices and motivated to operate microfinancing projects in many countries.

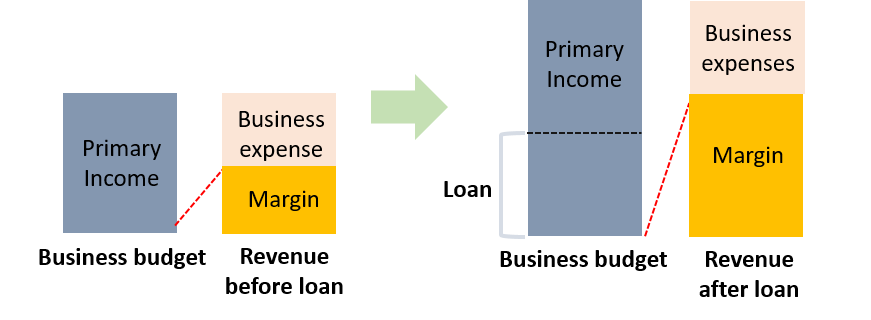

Micro finance is a tool that allows the marginalized to community attain financial independence. Donations cannot resolve low capital causing chronic low income, social issue, without lessening the dependency on aid. Following cases from India indicates that GNGIF’s efforts are bearing fruit. GNGIF is moving toward increasing financial independence and changing the livelihood of the community we serve, in the most sustainable way.

# Case 1: Roadside Food Cart Business

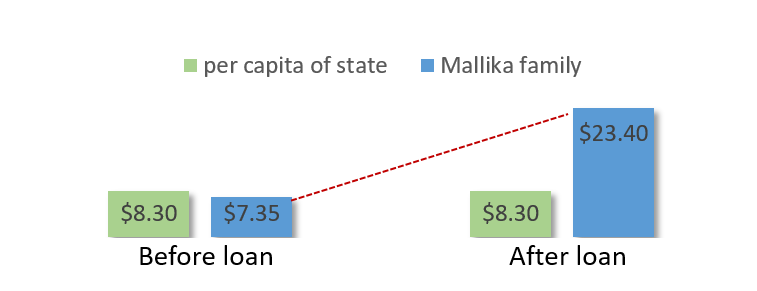

Mallika is a housewife and her husband is a daily wage worker. It was very hard to find regular jobs and the family income was lacking to afford a steady increase of expenses such as education and health expenses. Mallika participated in a self-help group(SHG) and learned the benefits of saving, awareness on Income generation activities in the locality. She borrowed loans from the SHG, that received GN’s Revolving Fund to start a roadside food cart business.

[Daily Income Changes]

Now, her family could support their children’s education and build a new house with their own income. Motivated by her success, the many others in the SHG have started small enterprises by borrowing loans from SHG and repaying promptly as they can avail refinance in time.

# Case 2: Cow Rearing Business

Sujatha and Subramani used to work in a wine yard but the wages were very low and the job was insecure due to COVID-19. As Sujatha is member of Self-help group, she received income generation training and borrowed loans from the SHG which funded by GN India. She purchased a cow and started selling 28 to 30 liters of milk every day.

[Creating sustainable income thru economic activities]

GNGIF is NOW…